All pages

1

Supply chain grips the industry

Cover and contents

2

Huge increases in lead times

Huge differences in lead-times makes supplies uncontrollable

3

Suzhou Shengyi

Better Choice. Better Riding.

4

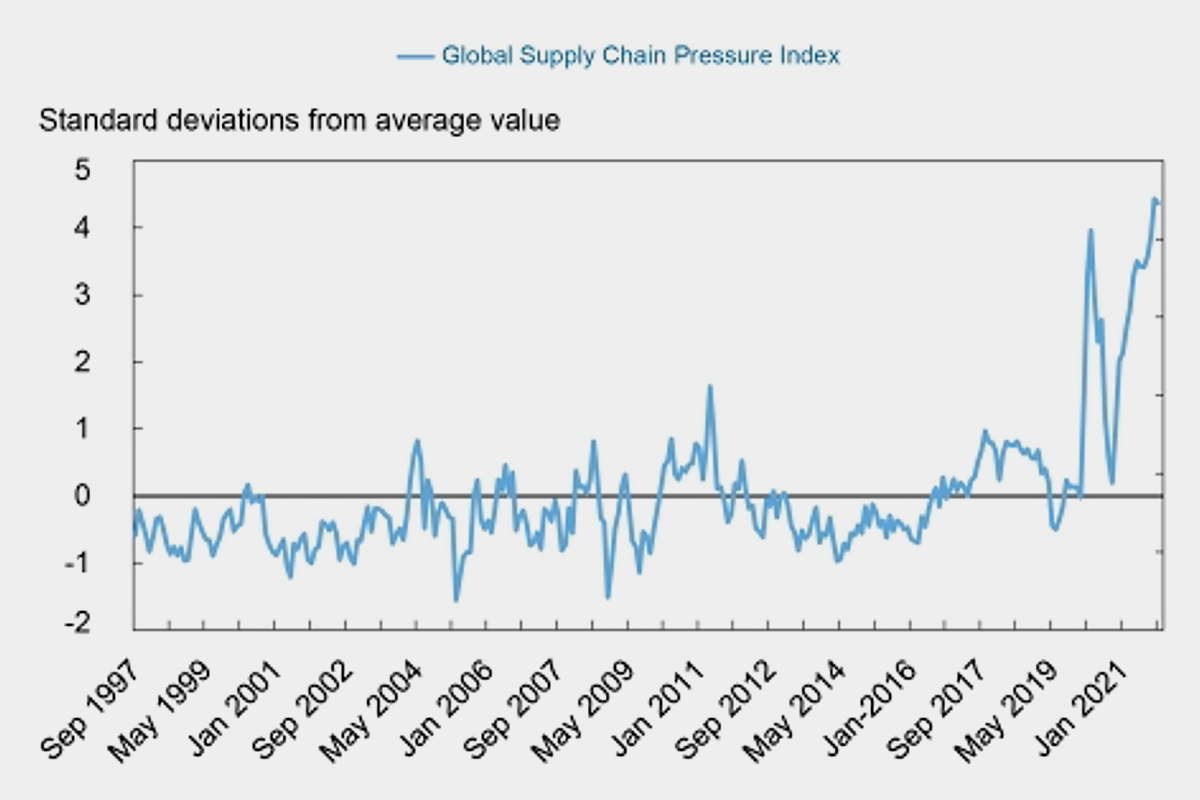

Global supply chain index

Global supply chain pressure index at an all-time high

5

Neco

Makes your life better

6

Bicycle industry interviews

Industry insiders reflect on supply chain issues

7

Lishui

The advantages of Lishui’s AIoT System

8

Impact on battery market

An e-bike with no battery?

9

Derivados

Eurobike: consequences two months later

10

Interview Bart Vos

“I don't expect reshoring to become a major trend”

11

Mando Pedalrite

Mando Pedalrite: A perfect solution for the last mile

12

Reshoring production in Europe

Reshoring production in Europe gathers pace

13

DDK Group Co Ltd

High-tech vacuum proces to bond the cover and pad the saddle shell

14

Taiwan exports stats versus EU imports

Boom boosts Taiwan's export revenues

15

Velo Saddles

Velo introduces atmosfoam using nitrogen process

All editions

Search

Search, through all Editions